KPI (Key Performance Indicators)

A measurable metric that shows how effectively your business is achieving a particular goal.

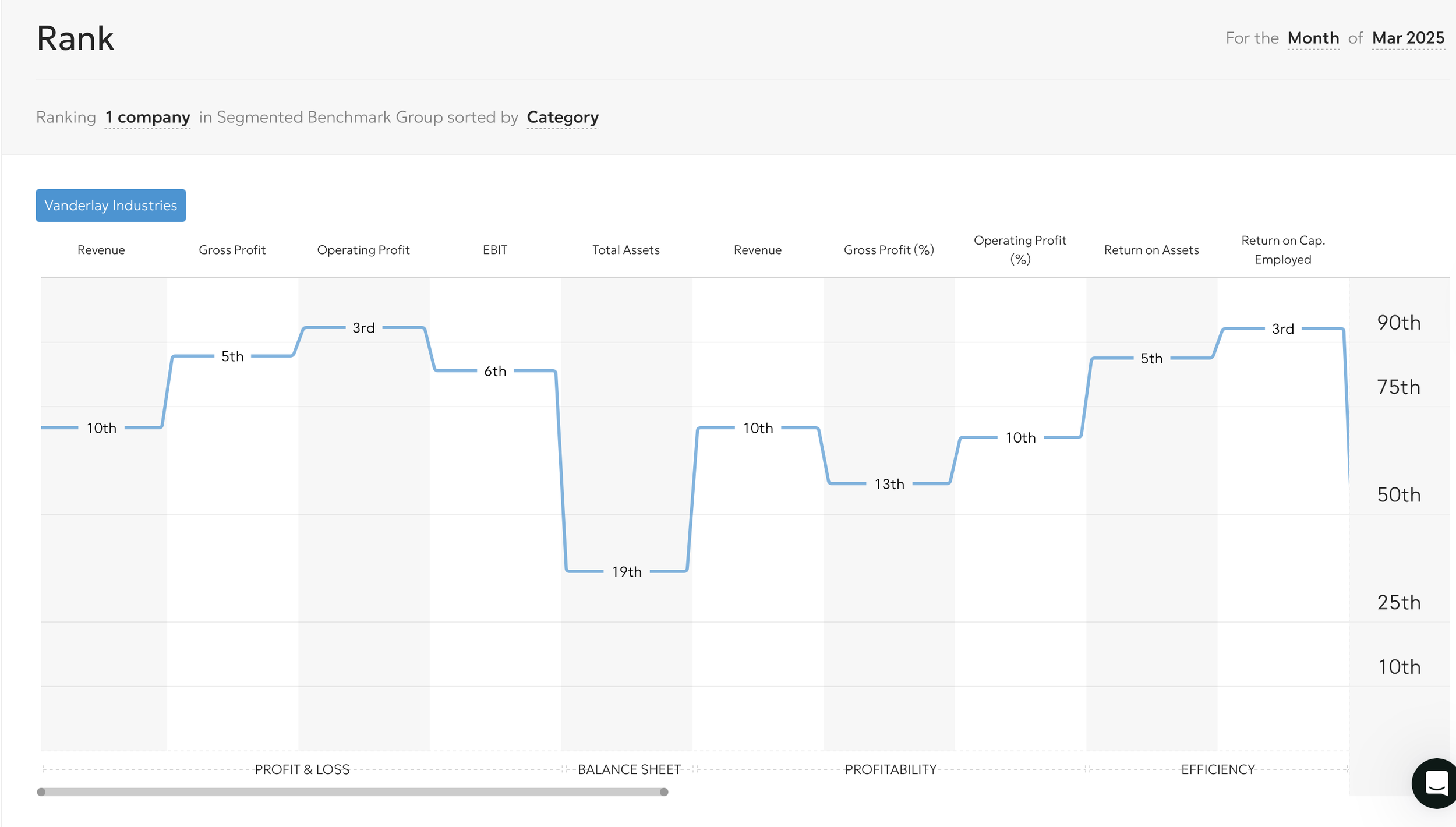

Financial Dashboard

A real-time, visual tool that displays several KPIs you want to monitor—cash flow, profitability, revenue trends, margins, and other KPIs—in one place.

Business owners can drown in reports and still not have visibility into better decision-making. A financial dashboard turns timely bookkeeping into a leadership tool, revealing trends, patterns, and risks before they become problems.

How We Build You a Custom Dashboard

Step 1

Starts with Bookkeeping

Every dashboard is only as good as the data behind it.

We start by bringing your financials up to a disciplined standard — cleaning your chart of accounts, reconciling balances, correcting misclassifications, and ensuring every transaction is in the right place.

When your books are clean, current, and accurate, your dashboard becomes something you can trust.

This step is what turns raw accounting into reliable intelligence, giving you the confidence that each KPI reflects reality, not noise.

Step 2

KPI Buildout

Not every business needs 50 metrics — you need the right ones.

We work with your leadership team to identify the financial indicators that actually drive performance in your business model.

We don’t overwhelm you with data.

We select a handful of KPIs that reveal the proper health, risks, and opportunities inside your business.

This is where your numbers become a strategic tool instead of a complicated spreadsheet.

Step 3

Live Dashboard Setup

Once your KPIs are defined, we build a custom live dashboard that connects directly to your bookkeeping system and updates automatically.

The result:

No more waiting for month-end reports

No more digging through spreadsheets

No more calls asking “How did we do this month?”

You get instant visibility into the numbers that matter most — displayed in a clean, intuitive, CEO-friendly format that anyone on your leadership team can understand.

Your dashboard becomes the daily, weekly, and monthly command center for running the business.

Step 4

Continued Development

A dashboard is powerful — but only if you know how to use it.

This is where the real impact happens.

We hold recurring financial coaching sessions to:

Review KPI trends

Identify risks or declining metrics early

Track progress toward financial goals

Strengthen decision-making

Adjust KPIs as your business evolves

Build financial discipline across the leadership team

Teach you how to run the business through the numbers

This step turns insight into action.

What KPIs Would You Want On Your Dashboard?

Ten of The Most Requested KPI’s

- Cash Balance (and Runway) - Revenue Trend (Monthly / Rolling 12-Month)

- Accounts Receivable Aging - Operating Expenses (vs Budget)

- Accounts Payable Aging - Cash Conversion Cycle

- Gross Profit Margin - Forecast vs Actual (Variance)

- Net Profit Margin - Working Capital

Industry-Specific KPIs

Construction & Trades

- Earned Value / Cost-to-Complete

- WIP Schedule Variance

- Backlog Margin

- Project Cash Flow Timing

- Field Labor Efficiency

- Change Order Conversion Rate

- Work-in-Progress (WIP) Accuracy %

Logistics, Transportation & Fleet

- Cost per Mile

- On-Time Delivery %

- Route Efficiency Score

- Accident / Incident Frequency

- Maintenance Cost per Vehicle

- Load Capacity Utilization

- Idle Time Percentage

- Average Delivery Time

Manufacturing & Production

- Throughput Rate

- Scrap, Rework, or Defect Rate

- Yield Percentage

- Machine Downtime %

- Production Schedule Adherence

- Cost per Unit

- Inventory Accuracy %

- Raw Material Turnover

Sales Focused KPIs

- Total Revenue (Monthly / Quarterly)

- Revenue Growth Rate

- New Revenue vs. Returning Revenue

- Average Deal Size

- Sales Pipeline Value

- Pipeline Coverage Ratio (pipeline ÷ quota)

- Lead-to-Close Conversion Rate

- Win Rate